Although consolidated payments for the facility portion of SNF care are hot on the RACs’ issue list for 2012, the professional side is also key to beating a Part B audit. In 2011, per HDI, issues for Region D included visits to patients in nursing facilities and visits to patients in swing beds. Payment for Part B SNF care carries a lower RVU value, which, to no one’s surprise, has become a RAC focus being as this area of coding is often misunderstood. Per the fine print provided by HDI, nursing facilities and hospital units providing “swing beds” constitute services often coded as inpatient, thus creating an overpayment for professional services. Another key element to coding these visits properly is reporting the correct POS, which, based on type of facility, also may account for a revenue differential.

Reviewing SNF Criteria

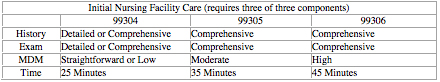

When reviewing E/M code selections for skilled nursing facilities, CPT focuses on three separate sections located under the Nursing Facility Services subsection. Included are codes for initial assessments (99304-99306), subsequent visits (99307-99310) and discharge care (99315-99316).

In billing for the initial day of service, providers should document the three components required for these codes (i.e. history, exam and medical decision-making), no different than for hospital or OBS admissions.

Another coding rule noted by the Centers for Medicare & Medicaid Services (CMS) mandates the use of an “AI” modifier to indicate the attending physician of record. All other initial days billed by physicians or qualified NPPs do not require the “AI” modifier, per the Medicare Claims Processing Manual (CMS Publication 100-04; Chapter 12, § 30.6.13.A.)

When billing for subsequent days, providers only are required to document two of the three key components (history, exam, medical decision-making). The major difference between SNF and subsequent hospital codes is the option to choose from four levels of service. In national audits, it’s not uncommon to find undercoding, as 99310 is one of the few comprehensive codes for subsequent services.

Keep in mind that when a provider bills based on counseling time, documentation must show a) the total time; b) that at least 50 percent of the total time was spent counseling; and c) the specific details as to what was recommended to the patient or caretaker. Time statements alone will not satisfy CMS guidelines.

Discharge services are broken down by time even if the time the provider spends with the patient is not continuous. This means the provider could spend 10 minutes with the patient in the early morning and then come back at noon to spend another 35 minutes discharging the patient (for a total of 45 minutes).

Code 99315 indicates discharge management of 30 minutes or less, which does not require specific documentation of time. Code 99316 indicates discharge management of more than 30 minutes. This code is time-driven and must show that more than 30 minutes was spent performing the discharge service.

In addition to reconciling the proper level of E/M service, place of service has a significant bearing on professional reimbursement. Place of service codes 31 (skilled nursing), 32 (nursing facility), 54 (ICF) and 56 (psychiatric residential treatment centers) are all common locations as it pertains to billing SNF services.

Visits to patients in swing beds represent another vulnerable area that may prompt RACs to assess automated data. Patients in swing beds should be billed based on their current status. Whether they are observation, inpatient or nursing facility status, E/M codes must coordinate with the status of the patient, per the Medicare Claims Processing Manual (CMS Publication 100-04; Chapter 12, § 30.6.9.D.)

Per regulations, transfer situations also may lend themselves to incorrect coding when a patient in a swing bed changes status. As stated in CMS Publication 100-04; Chapter 12, § 30.6.9.E:

Physicians may bill both hospital and discharge management codes and initial hospital care codes when the discharge and admission do not occur on the same day if the transfer is between:

· Different hospitals;

· Different facilities under common ownership which do not have merged records; or

· Between the acute-care hospital and a PPS-exempt unit within the same hospital when there are no merged records.

In all other transfer circumstances, the physician should bill only the appropriate level of subsequent hospital care for the date of transfer.

Note that in the last sentence of this excerpt, you are instructed to bill only the appropriate level of subsequent hospital care for the date of transfer when one of the above bulleted set of circumstances do not exist. This means that if a swing bed patient’s status changes to nursing facility, you only would bill the appropriate subsequent nursing facility code for that day (99307-99310).

Check with your local MAC and RAC region to keep up on local medical review policies regarding SNF billing rules. Published at RAC Monitor.